Join the Fight in NWC's 90-Day Policy Sprint for the New DOJ Whistleblower Program

The Department of Justice has announced a 90-Day window to decide on the policies and practices that will govern its new Whistleblower Program. In response, National Whistleblower Center has launched a rapid campaign to recommend whistleblower best practices and rewards to establish an effective DOJ Whistleblower Program. Learn more and take action today.

Join our mailing list to stay updated and donate today to support our advocacy work!

News & Press Releases

Priority Campaigns

What We're Working On

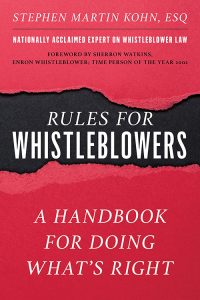

New Book Release

By NWC's Chair Stephen M. Kohn

Purchase the Rules Book and All Proceeds Directed to the NWC!

Order Now