Creating an Effective Anti-Corruption Program: A Rebuttal to the Bank of England’s Findings on Whistleblower Incentives

Published June 2018

Download the PDF version of the report here.

INTRODUCTION

At the request of the United Kingdom’s Parliament, the Bank of England Financial Conduct Authority (“FCA”) and the Prudential Regulation Authority (“PRA”) issued a report entitled Financial Incentives for Whistleblowers (hereafter, “BoE Report”).1 The report was written following the visit of several U.K. officials to the United States to observe its whistleblower laws and programs. Among the findings of the report were that U.S. whistleblower reward programs are largely ineffective and costly.

Since its publication in 2014, the BoE Report has been relied upon by government officials, NGOs, and other stakeholders as a justification for rejecting the use of financial incentives to encourage whistleblowing.

Yet the BoE Report is rife with inaccuracies. It is premised on false and misleading information that distorts the crucial role of whistleblower rewards to ensuring that financial crimes are detected and prosecuted. The BoE Report has stifled any momentum within the U.K. for the enactment of an effective whistleblower program.

In fact, whistleblower incentives have been the cornerstone of anti-corruption laws in the U.S. for decades.

U.K. Parliament needs an accurate assessment of the potential of such laws in order to take appropriate legislative action to protect investors and the public from the devastating impact of fraud and corruption.

This special report by the National Whistleblower Center addresses these inaccuracies and provides a path for future resolution.

PART I

Whistleblower reward laws increase quality reports and are integral to combating corruption.

The BoE Report premised its opposition to laws that create financial incentives for whistleblowers on the assumption that the U.S. reward laws did not work. According to the BoE Report: “None of the [U.S.] agencies have seen a significant increase in either the number or the quality of reports from whistleblowers.”

This statement is not true. The U.S. regulators responsible for implementing the whistleblower reward laws have strongly praised them as crucial instruments for fighting fraud, specifically pointing to the high number of quality of such tips.

For example, the U.S. Department of Justice (“DOJ”) has praised qui tam and whistleblower reward laws, such as the False Claims Act (see quote).

[The False Claims Act is] the most powerful tool the American people have to protect the government from fraud. — Former Assistant Attorney General Stuart Delery, Remarks at American Bar Association’s 10th National Institute on the Civil False Claims Act and Qui Tam Enforcement (2014)

According to the U.S. Securities and Exchange Commission

The “whistleblower program… has rapidly become a tremendously effective force-multiplier, generating high quality tips, and in some cases virtual blueprints laying out an entire enterprise, directing us to the heart of the alleged fraud.”

A whistleblower “admission often brings…[an] added measure of public accountability.”

“[W]ith growing frequency and success [the SEC utilizes] our whistleblower authority, which enables us to award those who come forward with evidence of wrongdoing.”

— Former Chairman Mary Jo White, U.S. Securities and Exchange Commission (2013)

According to the U.S. Department of Justice

“The whistleblowers who bring wrongdoing to the government’s attention are instrumental in preserving the integrity of government programs and protecting taxpayers from the costs of fraud. We are extremely grateful for the sacrifices they make to do the right thing.” — Former Assistant Attorney General Stuart Delery, U.S. Department of Justice (2012)

“The False Claims Act and its [whistleblower] provisions remain the government’s most effective civil tool in protecting vital government programs from fraud schemes.” — Acting Associate Attorney General Bill Baer, Remarks at American Bar Association’s 11th National Institute on the Civil False Claims Act and Qui Tam Enforcement (2016)

“Because those who defraud the government often hide their misconduct from public view, whistleblowers are often essential to uncovering the truth. The [Justice] Department’s [monetary] recoveries this past year continue to reflect the valuable role that private entities can play in the government’s effort to combat false claims.” — Acting Assistant Attorney General Chad A. Readler, Department of Justice, Civil Division (2017)

The number of persons using U.S. reward-based reporting laws and the amount of revenue obtained by the U.S. government demonstrates the effectiveness of these reward laws.

The oldest U.S. whistleblower reward law, the False Claims Act, was modernized in 1986 to permit whistleblowers to report fraud across a wide range of areas.3 Between 1986 to 2017, the total amount recovered in successful civil fraud prosecutions by the U.S. Department of Justice (DOJ), Civil Division was over $56 billion. Of that amount, over $40 billion, or over $72%, was recovered based on information provided by whistleblowers.5 As a result, the statements by the DOJ, which is responsible for False Claims prosecutions, as to the effectiveness of whistleblower rewards, are particularly impactful.

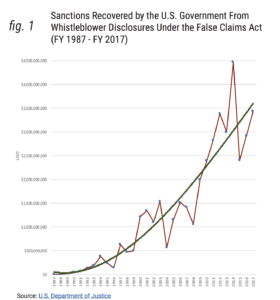

This graph represents the increase of funds recovered by the U.S. government through sanctions following the introduction of whistleblower monetary incentives in the 1986 amendments to the False Claims Act. The polynomial trendline overlaid on the graph illustrates the general rising trend of recoveries over the 30-year period. For example, from 2008-2012 recoveries more than tripled from $1B USD to over $3.3B USD. Source U.S. Department of Justice

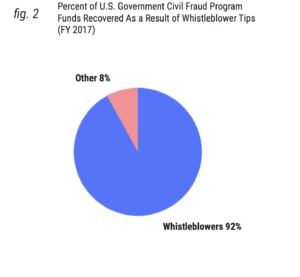

In FY 2017, the U.S government recovered over $3.7 billion through its civil fraud program. Of this amount, whistleblowers were directly responsible for the detection and reporting of over $3.4 billion, under qui tam provisions. As such, whistleblowers were the source of the detection of 92.8% of all civil fraud recovered in FY 2017. Moreover, of the $3.4 billion recovered through the FCA and as a result of whistleblower assistance in FY 2017, $392 million (11.5%) was awarded to whistleblowers. Source: U.S. Department of Justice

PART II

The BoE Report Falsely Claims U.S. Whistleblower Programs Have Been Ineffective

The BoE Report Relies on Groups and Agencies That Have No Whistleblower Program or Authority as Sources of Information

The BoE Report’s description of its fact-finding trip to the United States to learn about reward laws demonstrates a grossly negligent investigation. Investigators claim that their travels to the U.S. involved meeting with regulators who had “powers under the 2010 Dodd-Frank Act to pay awards.” These investigators reported that based on their fact-finding mission they “found scant evidence that the U.S. system leads to more disclosures or better information.” However, any reader with a basic understanding of whistleblower programs in the U.S. would clearly find fundamental problems with these statements.

The BoE Report states that investigators “met the Office of the Comptroller of the Currency.” Yet the Comptroller of the Currency has no whistleblower program, no authority to pay any rewards, and does not oversee any criminal or civil investigations for which whistleblowers can obtain rewards from other agencies.

The BoE Report also states that investigators met with representatives of the United Nations, which has no jurisdiction over U.S. laws, including U.S. whistleblower laws, nor any reward program itself. Moreover, the U.N. has been itself accused of retaliation against its own employees, who lack protection from the organization itself and instead rely on national laws.

The BoE Report also states that the delegation “visited the U.S. Department of Justice, which has the power to make awards to whistleblowers in retaliation to prosecutions under the Foreign Corrupt Practices Act.” The problem with this statement is that the DOJ has no responsibility over the Foreign Corrupt Practices Act (“FCPA”) reward program. In other words, there is no U.S. Department of Justice-FCPA whistleblower program, and that agency does not pay rewards. Under the Dodd-Frank Act only the Securities and Exchange Commission (“SEC”) has the authority to pay rewards under the FCPA.

U.S. Securities and Exchange Commission Regulators’ Praise for U.S. Whistleblower Programs Was Omitted and Falsified in the BoE Report

The SEC officials’ statements found in the BoE Report appear to be highly misleading. This fact was exposed in 2017 in a Bloomberg article, titled “Why Whistleblowers Get Paid in the U.S. but Not in Britain.” An interview with the Former Director of the SEC’s Office of the Whistleblower reveals what actually transpired. After a meeting in which the SEC “eagerly laid out the program’s merits… [the visitors were] invited to stick around for a week to observe it in action.” The investigators declined that offer and instead paid visits to groups that had no responsibility for administering reward laws or working with whistleblowers.

Senator Charles Grassley: A Missed Opportunity

The BoE Report failed to interview Senator Charles Grassley (R-Iowa), the Chairman of the Senate Judiciary Committee and the author of the 1986 amendments to the False Claims Act, which focus on whistleblower rewards and are the basis of the modern whistleblower reward laws in the U.S. Below are some quotes from Senator Grassley that highlight the importance of whistleblowers in combating government waste, fraud, and abuse.

“One of the smartest things Congress has ever done is to empower whistleblowers to help the government combat fraud. They get results. Without whistleblowers, the government simply does not have the capability to identify and prosecute the ever-expanding and creative schemes to bilk the taxpayers. That is not rhetoric. That is history.”

“The modern-day False Claims Act is now 30 years old. It is the most successful piece of anti-fraud legislation in U.S. history…”

“The facts speak for themselves. The False Claims Act works.”

Source: Statement for the Record by Senator Chuck Grassley, House Judiciary Subcommittee on the Constitution and Civil Justice Hearing on “Oversight of the False Claims Act” (2016)

The BoE Report Omits Any Literature Review

The BoE Report does not appear to contain any literature review studying the application of reward laws. A seminal study on the effectiveness of whistleblowing and its value in law enforcement efforts on corporate fraud was first published by the University of Chicago’s Booth School of Business. On the basis of an in-depth analysis of “all reported fraud cases in large U.S. companies between 1996 and 2004,” the authors concluded that.

“A strong monetary incentive to blow the whistle does motivate people with information to come forward.”

“There is no evidence that having stronger monetary incentives to blow the whistle leads to more frivolous suits.”

“Fraud tends to be revealed by people who find out about it in their normal course of business and who do not have a strong disincentive (or even better some positive incentive) to reveal it.”

Source: The Journal of Finance, “Who Blows the Whistle on Corporate Fraud?

These findings rebut the BoE Report’s conclusion that monetary incentives could result in abusive lawsuits or necessarily result in negative side effects.

The Fear of the Malicious Use of Whistleblower Laws is Misguided

The claim that reward laws might lead to an increase in malicious reporting has been investigated and shown false by the leading comprehensive study on whistleblower rewards for detecting fraud.19 Moreover, financial reward laws are structured to require the whistleblower to have original and well-documented information, and to be truthful.

The speculation that reward laws could damage the reputation of innocent parties is a profound misunderstanding of how reward laws work. All U.S. reward laws require that truthful information be provided to responsible law enforcement officials, not the press.

The BoE Report Fails to Understand the Importance of Confidentiality in Preventing Retaliation

The BoE Report’s criticism of the confidentiality provisions of reward laws is misplaced. Such confidentiality provisions are critical for protecting employees from retaliation. Further, many potential whistleblowers will not step forward with information unless there is a guarantee of confidentiality. As such, confidentiality is a critical element in creating effective whistleblower laws.

A report by the Thompson Reuters Foundation and Blueprint for Free Speech identified the failure to protect whistleblowers before retaliation as one of the major defects in the U.K. whistleblower law.

In short, confidentiality is the key to preventing retaliation. Retaliation is a moot point when the company in question never knows the identity of the whistleblower.

Concerns Over Harmful Effects of Internal Whistleblowing and Exploitation of Laws Is Also Unfounded

The assumption that “incentives offered by regulators could undermine the introduction and maintenance by firms of effective internal whistleblowing mechanisms” is rebutted by the SEC Chairman Mary Jo White, who confirmed that the SEC’s whistleblower policies have created stronger and more effective compliance programs on Wall Street.

” All indications are that internal compliance functions are as strong as ever – if not stronger – and that insiders continue to report possible violations internally first. […] Notably, of these, over 80% first raised their concerns internally to their supervisors or compliance personnel before reporting to the Commission.”

Source: Former Chairman of the SEC Mary Jo White, Northwestern University School of Law (2015)

Whistleblower Programs Restore, Not Deplete, Government Coffers

The speculation that the implementation of reward laws would require a costly governance structure is false. Evidence demonstrates that whistleblower reward laws have recouped billions of dollars to the U.S. government (see fig. 1 and fig. 2).

The claim that such whistleblower incentives “benefit only the small number whose information leads directly to a successful enforcement action resulting in the imposition of fines” is misleading. Financial incentives benefit the public-at-large through billions of dollars returned to government coffers and to NGOs and other stakeholders for restitution purposes.

A comprehensive study on the costs to the government incurred for investigating whistleblower cases under the False Claims Act found that the government’s direct return on investment exceeds 20:1 This does not include the benefits obtained by holding criminals accountable and the deterrent effect accomplished through stricter oversight.

PART III

The Lack of Effective Anti-Corruption Programs Has Resulted in Foreign Nationals, Including U.K. Citizens, Utilizing U.S. Reward Laws

The potential impact of whistleblower incentive programs is best demonstrated by international response to U.S. whistleblower laws. International whistleblowers, once aware that several U.S. laws allow for such compensation, have reported their insider information to U.S authorities in large numbers. Whistleblowers from around the world have properly disclosed evidence of fraud or corruption once given the opportunity to do so without fear of suffering severe economic or personal consequences.

“[A]llowing foreign nationals to receive awards under the [SEC] program best effectuates the clear Congressional purpose underlying the award program.” — 2014 Annual Report, SEC Office of the Whistleblower, P.10

Another class of cases where whistleblower tips can be helpful is in our enforcement of the Foreign Corrupt Practices Act. […] Tips related to FCPA violations have increased from 115 in fiscal year 2012 to 186 in fiscal year 2015—an approximate 62% increase. Because of the difficulties in investigating overseas conduct, we are hopeful this trend will continue. […] [I]nternational whistleblowers can add great value to our investigations. Recognizing the value of international whistleblowers, we have made eight awards to whistleblowers living in foreign countries. In fact, our largest whistleblower award to date—$30 million—went to a foreign whistleblower who provided us with key original information about an ongoing fraud that would have been very difficult to detect. In making this award, the Commission staked out a clear position that the fact that a whistleblower is a foreign resident does not prevent an award when the whistleblower’s information led to a successful Commission enforcement action brought in the United States concerning violations of the U.S. securities laws. — Former Director of Enforcement at the SEC, Andrew Ceresney, Sixteenth Annual Taxpayers Against Fraud Conference (2016)

U.K. Citizens Utilize U.S. Whistleblower Reward Laws

Under the Dodd-Frank Act’s whistleblower law, non-U.S. citizens can receive awards when they expose securities frauds and violations of the FCPA by foreign companies that trade in American Depository Receipts, covering many companies traded on international stock exchanges. Even without widespread awareness of this provision, the response by international whistleblowers has been overwhelming.

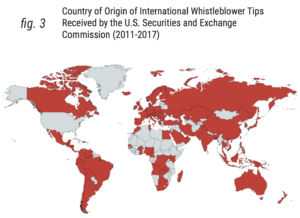

Between 2011 to 2017, 2655 international whistleblower tips were received from 113 different countries. In fact, the U.K. led the pack, with 438 whistleblower tips, the largest amount of any country. These numbers are particularly remarkable as the U.S. securities law only covers a tiny fraction of the workforce.

Red indicates whistleblower tips were received from this country. Gray indicates no whistleblower tips were received from this country. Please note this chart is solely looking at non-U.S. sources, and as such excludes the U.S. in the graphic. Source: U.S. Securities and Exchange Commission, Annual Reports to Congress Under Dodd-Frank Whistleblower Program (2011-2017)

CONCLUSION

The BoE Report’s principal finding that reward laws do not increase the number or the quality of reports from whistleblowers is not true. Instead, statements from lawmakers, law enforcement who work directly with whistleblowers on the ground, and appointed leadership in the agencies which have implemented whistleblower programs, demonstrate the high regard they have for whistleblowers and the information they bring to light.

Statistics on the use of whistleblower tips by the relevant agencies verify their effectiveness. The BoE Report’s investigators did not speak with relevant sources and disregarded the information given in favor of whistleblower programs by those with knowledge on actual program implementation. The immense response by international whistleblowers to U.S. reward programs demonstrates the effectiveness of such laws and especially when given an international reach.

It is critical that the U.K. Parliament and others interested in the use of whistleblower rewards are given accurate information. The BoE Report contains too many misleading statements and errors to be of any continued use.

Whistleblower reward laws address both the short-term and long-term problems caused by the realistic fear employees experience when they consider blowing the whistle.

Reward laws create an incentive for employees to take the risk to report fraud.

Reward laws establish safe and protected channels for reporting.

Reward laws place a premium on raising concerns that are valid, well-documented, and provable. The only way to prevail in a reward law is to be right about the wrongdoing.

Reward laws permit employees who disclose their fraud-based allegations to the government to obtain protection from retaliation, along with traditional employment discrimination and anti-retaliation laws.

Reward laws give employees a choice to report internally or to report through a government-protected channel that can offer financial safeguards; in conjunction with anti-retaliation laws, these serve as powerful incentives. This creates powerful motivation for companies to compete with government programs by creating independent and effective compliance programs.

Reward laws permit the appropriate authorities to obtain evidence of fraud and conduct effective investigations designed to protect the public interest.

ACKNOWLEDGMENTS

Stephen M. Kohn is a partner in the law firm Kohn, Kohn & Colapinto, LLP and one of the U.S.’s leading attorneys and advocates for whistleblowers. He serves pro bono as the Executive Director of the National Whistleblower Center. He has represented whistleblowers since 1984, successfully setting numerous precedents that have helped define modern whistleblower law and obtained the largest reward ever paid to an individual whistleblower ($104 million for exposing illegal offshore bank accounts). He is regularly consulted by U.S. Congressional committees and helped draft whistleblower provisions in the Sarbanes-Oxley, Dodd-Frank, and Whistleblower Protection Enhancement Acts. He teaches a seminar on whistleblower law at Northeastern Law School, and has published numerous books on whistleblower law, including The New Whistleblower’s Handbook.

Maya Efrati is a Legal Fellow at the National Whistleblower Center. Her work focuses on strengthening the institutions of our democracy and advocating for good governance reforms with nonprofit organizations, including policy analysis, legislative advocacy, and as legal counsel. She earned her J.D. from the University of Michigan Law School, simultaneously earning her M.P.P. from the University of Michigan Gerald R. Ford School of Public Policy. In a legal capacity, she previously worked for the Michigan Innocence Clinic, the Center for American Progress, FairVote, and Represent.Us. Before law school, she also worked for a large Congressional campaign, AFSCME Council 36, and the Peres Center for Peace, among others.

Julia S. Malleck is a Communications Fellow at the National Whistleblower Center. She graduated magna cum laude from Tufts University in 2016 with a B.A. in International Relations and has also studied at SOAS, University of London, and at Suzhou University in China. Previously, Ms. Malleck has interned for the Society for International Development, EastWest Institute, and in UK Parliament for former MP Rt Hon Simon Hughes.

Thank you to National Whistleblower Center interns Caroline Buthe, Michael Ellis, Jacob Gardner, and Ben Kostyack for their indispensible research and assistance in creating this report.

The PDF of this report, as well as other resources related to NWC’s advocacy on this issue, can be accessed and downloaded here.