The disruption of the earth’s climate is one of the greatest challenges facing our society. Greenhouse gas emissions are continuing to increase, as evidenced by a Global Carbon Project report finding that in 2019, despite impressive progress with clean energy, global fossil fuel emissions had increased for the third straight year. And these emissions are already having dramatic impacts.

Sea levels are rising. Animal and plant species are rapidly going extinct. Natural phenomena like hurricanes and forest fires are becoming increasingly more violent. And the impacts of greenhouse gas emissions are not spread evenly. Those who have contributed the least to the problem – the poorest communities around the world and the generations to come – will experience the greatest impacts.

Climate change poses an enormous threat to our economy and quality of life, and readily available solutions are not being implemented fast enough to head off the worst damage. That’s why the National Whistleblower Center (NWC) launched our Climate Corruption Campaign in January 2020, with a focus on the fossil fuel and timber industries as well as their professional enablers, including the securities and banking industries.

The Climate Corruption Campaign’s banking and finance work is focused on one central concept: banks and other financial institutions are significantly exposed to climate risks, and these institutions are not adjusting to these risks at the pace or scale necessary to avoid destabilizing the climate or the economy.

Without sufficient oversight, banks and other financial institutions could hide the extent of their climate-related financial risks or make misleading claims about their sustainability efforts. That’s why NWC is calling on financial regulators to integrate climate change and climate-related risks into their supervision of banks and other financial institutions.

Financial regulation that accounts for climate risk is necessary to protect the environment and the economy, but whistleblowers don’t have to wait. If banks attempt to mislead regulators about climate-related risks, such as the level of exposure to climate risks in their loan portfolios, whistleblowers can use powerful U.S. whistleblower laws to report this. NWC is educating and assisting whistleblowers in the banking and finance industries with evidence of climate-related risks and other potentially fraudulent information. Learn more about how we help whistleblowers find an attorney here.

REPORT CLIMATE CRIMES CONFIDENTIALLY

Climate Risk Must Be Incorporated into Financial Institution Oversight

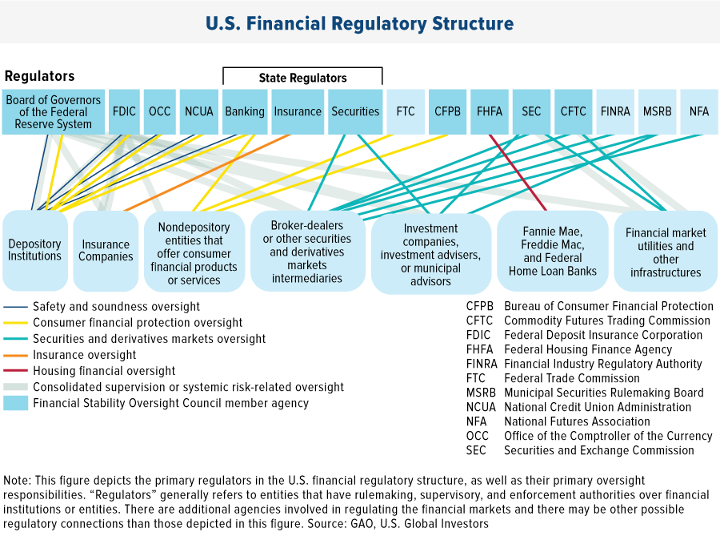

In the United States, several federal regulators have the authority to introduce climate risk into their supervision of banks and other financial institutions. The Federal Reserve, the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Financial Stability Oversight Council can each play a role in integrating climate risks into supervision of firms and the financial system.

Additionally, the Dodd-Frank Act, passed in 2010 in response to the financial crisis, provided significant discretionary authority to federal regulators to “prevent a recurrence or mitigate the impact of financial crises that could cripple financial markets and damage the economy.”

The Financial Stability Oversight Council (FSOC), created by the Dodd-Frank Act, is tasked with identifying risks to the stability of the financial system. FSOC could coordinate climate-related actions by other financial regulators and facilitate information-sharing on climate risks. The Dodd-Frank Act also gave FSOC the authority to designate a nonbank financial company as “systemically important financial institutions” (SIFIs), which are supervised by the Federal Reserve and subject to enhanced regulation.

The Federal Reserve is tasked with supervising systemically important financial institutions, such as JP Morgan, Bank of America, Citigroup and Wells Fargo and has the authority to impose additional requirements on these institutions. The Federal Reserve could integrate climate risk into its micro-prudential (firm-level) regulation of these financial institutions. In January 2021, the Federal Reserve announced the creation of a Supervision Climate Committee (SCC), which will examine how climate change affects individual banks.

The Federal Reserve can also require additional disclosures from the nonbank financial companies it supervises and bank holding companies of a certain size, according to a report on climate risk by the Commodity Futures Trading Commission. These disclosures would be in addition to the disclosures required by the SEC for publicly-listed banks.

A report from the sustainable investor group Ceres highlights that the Federal Reserve could build on existing frameworks created by the Platform for Carbon Accounting Financials and work with the SEC to require banks to assess and disclose climate risks.

The Dodd-Frank Act also gave the Federal Reserve significant power to engage in macroprudential regulation, regulation designed at addressing systemic risks. In March 2021, the Federal Reserve also announced the creation of a second committee, the Financial Stability Climate Committee (FSCC). The FSCC will address climate-related risks to the stability of the financial system as a whole. Bank stress tests, which evaluate whether banks could withstand an economic downturn, are one such type of macro-prudential regulation. To test for systemic climate risk, the Federal Reserve could conduct climate stress tests.

According to a paper by the Great Democracy Initiative, under the Dodd-Frank Act, the Federal Reserve could update capital rules to increase risk weights for loans and investments in climate change-driving assets and credit exposures to sectors that are vulnerable to climate change. The Federal Reserve could also create stringent margin requirements for transactions that involve securities and derivative tied to the companies contributing the most to climate change.

In addition to the Federal Reserve, two other agencies oversee banks, the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC), could address climate risks. The OCC is an independent branch of the U.S. Department of the Treasury which charters, regulates, and supervises all national banks and federal savings associations, as well as federal branches and agencies of foreign banks. The FDIC is an independent agency created by Congress which insures deposits and examines and supervises financial institutions for safety, soundness and consumer protection.

The OCC and the FDIC can integrate climate-related risks into their risk management system. The OCC and FDIC also set the rules and parameters that banks use to conduct their bank-level stress tests, and these agencies could work with the Federal Reserve to integrate climate risks into stress tests.

How to Incorporate Climate Risk into Insurance Oversight

The industries driving climate change, including fossil fuels, depend heavily on insurance companies, as most oil, gas and coal infrastructure cannot operate without insurance. The oil and gas property and casualty insurance market is estimated at USD 17.3 billion, with U.S. insurance companies possessing the largest underwriting share.

In addition to the underwriting services that they provide, insurers are heavily invested in oil and gas. Insurance companies are the second largest investors in fossil fuels following asset managers and are regulated primarily by state insurance regulators.

State insurance regulators can require insurance companies to assess and disclose potential climate risks to their underwriting activity, as well as their investment portfolios. States could also require climate-stress testing for insurance companies. The California Department of Insurance (CDI) has required companies to complete a climate risk survey and published the results. The CDI has also conducted the first climate risk scenario analysis of insurers’ investment portfolios in the U.S.

The Dodd-Frank Act also created the Federal Insurance Office (FIO) of the Department of the Treasury to monitor “all aspects of the insurance industry, including identifying gaps in the regulation of insurers that could contribute to a systemic crisis in the insurance industry or U.S. financial system.” The FIO could assess climate risks facing the insurance sector and report these results to the FSOC. The FIO can also recommend to the FSOC that an insurer be designated as systematically important financial institution.

These actions can be further supported by strong disclosure requirements for publicly listed banks and other financial institutions that participate in the securities market. Learn more about NWC’s related work to strengthen climate risk disclosures in the securities industry here.

How Whistleblowers Can Help

While many investors are currently in the dark on climate risks, company insiders may know the extent to which the impact of climate change-related risks on financial assets have been illegally concealed from investors, regulators, and the public.

Stronger oversight of climate risks in the financial system will allow whistleblowers to better assist regulators in deterring, detecting and prosecuting climate-related financial fraud. To succeed in supervising climate risk at banks, regulators will need to depend on accurate information from banks and financial institutions, but banks that have failed to prepare for climate change will have significant motivation to mislead regulators. If banks and other financial institutions mislead regulators or the public about climate risks, whistleblower laws could protect and incentivize bank insiders to report that deception to regulators.

Thanks to the powerful whistleblower provisions in the Dodd-Frank Act, whistleblowers can confidentially report securities violations by publicly-listed banks and other financial institutions, including attempts to mislead investors or regulators about climate risks.

Bank whistleblowers in the past have also successfully used the False Claims Act, which has a powerful rewards provision, to report fraud at JP Morgan, Bank of America, Wells Fargo, and Citi. Another banking whistleblower law, the Financial Institutions Reform, Recovery, and Enforcement Act, has the potential to be a powerful tool for bank whistleblowers as well. To read more about NWC’s efforts to strengthen bank whistleblower laws under FIRREA, read more here.