At the beginning of January 2014, the Canadian Revenue Agency (CRA) launched its very first whistleblower reward law under the Offshore Tax Informant Program (OTIP) to track down tax cheats. Two years later, the province of Ontario, Canada took a step further and passed the Ontario Securities Commission (OSC) whistleblower program to protect investors from unfair and fraudulent practices.

To date, both of Canada’s whistleblower programs have been incredibly successful with whistleblowers receiving over CAD $1 million in rewards for their disclosures under the OTIP by 2019 and OSC whistleblowers receiving more than CAD $8.6 million since its establishment.

Offshore Tax Informant Program

The OTIP was first announced in the 2013 federal budget and follows measures similar to those implemented in the United States by the Internal Revenue Service’s Whistleblower Office. Under this program, a financial reward may be given to individuals who provide information to the CRA about major incidents of international tax non-compliance. However, it is important to note:

- The OTIP only applies to international tax non-compliance,

- To qualify for an award, the information provided must lead to the collection of at least CA$100,000 (about USD $79,932.50), and

- Awards range between 5% to 15% of the additional federal tax collected.

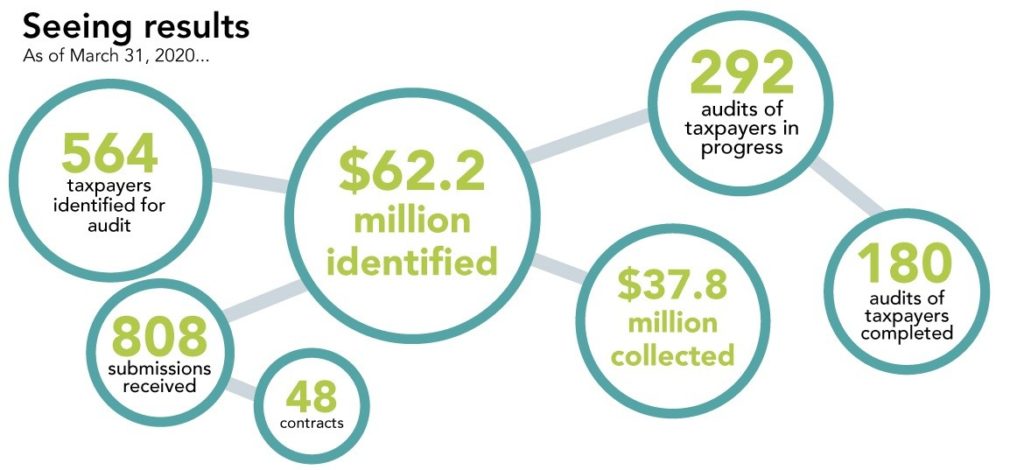

Between the launch of the OTIP to March 31, 2020, this program received 808 submissions, identified 564 taxpayers for audit, and audited 180 taxpayers resulting in over CAD $62.2 million in additional federal taxes and penalties identified. Of these submissions, the OTIP entered into 48 contracts with whistleblowers. According to an Access to Information Request, whistleblowers had received over CAD $1 million for their disclosures by 2019.

- Image by the Government of Canada

OTIP Eligibility and Exclusion

Whether you reside in Canada or not, anyone may qualify for the CRA’s reward program if the information provided includes specific and credible details that lead to additional taxes being assessed and collected. The information provided cannot already be known to the CRA or be speculative. Information received from potential whistleblowers about international tax non-compliance can range from failing to report foreign income to avoiding the payment of taxes they owe. Other examples include:

- A taxpayer failing to report offshore assets obtained before moving to Canada,

- Substantial assets are held through offshore corporations and provide cash flow to the taxpayer,

- A Canadian company offers customers considerable discounts if a part of the invoice is paid in cash. The unreported business income is then moved offshore,

- Canadian taxpayer owns properties in a foreign country from which rental income is earned and does not report that income to the CRA.

A whistleblower may not be eligible for a reward if they:

- have been convicted of tax evasion concerning the situation of non-compliance they are reporting;

- are a CRA employee;

- are or were a federal employee, official, or representative, and acquired the information in the course of their employment duties;

- are or were a contractor and acquired the information in the course of their duties for a federal, provincial, or municipal government;

- have been convicted of an offense listed under section 750 of the Criminal Code;

- are a taxpayer involved in the non-compliance;

- are currently an authorized representative of the taxpayer involved;

- are legally required to disclose the information to the CRA;

- received the information from an ineligible individual; or

- are providing the information anonymously.

Informants may submit information to the CRA anonymously; however, no reward will be made available to them. Should a person decide to submit information and not remain anonymous, their identity will be kept confidential. The CRA has strict protocols in place for handling information and will protect the identity of an informant to the fullest extent possible as required by law. Information collected under the authority of federal tax laws are protected under the privacy of the provisions of these laws, as well as by privacy laws that impose strict limits on what the CRA can disclose.

However, there are certain circumstances where the informant may be required to reveal their identity such as serving as an essential witness in a court proceeding where confidentiality is not feasible. The CRA will advise the informant before it decides to proceed in such cases.

The National Whistleblower Center advises any persons who believe they have information about international tax non-compliance in relation to Canada to contact a whistleblower attorney before making any disclosures. To learn more about how international whistleblowers can use U.S. laws, read The New Whistleblower’s Handbook, the first-ever guide to whistleblowing, by the nation’s leading whistleblower attorney. The Handbook is a step-by-step guide to the essential tools for successfully blowing the whistle, qualifying for financial rewards, and protecting yourself.

Ontario Securities Commission Whistleblower Law

The Ontario Securities Commission (OSC) whistleblower program is the first of its kind by a Canadian securities regulator. Under this program, the OSC accepts tips on violations of Ontario securities law including illegal insider trading, abusive short selling, trading related misconduct, and corporate disclosure violations.

In the first two years of the program, the OSC received approximately 200 whistleblower tips and began distributing awards in 2019. These awards range between 5% to 15% of the total monetary sanctions ordered by the Commission. To date, whistleblowers have received more than $8.6 million in awards, including a recent whistleblower award split between three people in November 2020.

Additionally, the OSC whistleblower program has robust whistleblower protections and follows strict confidentiality laws to ensure any information regarding a whistleblower’s identity is never revealed. Confidentiality extends across agencies and the OSC will not share any information with another regulator or law enforcement without a whistleblower’s explicit consent. However, if a whistleblower consents to the OSC sharing their information with other regulatory authorities, the OSC cannot guarantee the third-party organizations will keep the whistleblower’s identity hidden.

Should a whistleblower be retaliated against for their disclosure, they may seek civil remedies through the court system if arbitration under a collective agreement is not available. It will be on the company to prove their actions were not reprisal against an employee for blowing the whistle. Protections also include the employee’s reinstatement and the payment of two times the amount of lost pay. Additionally, any form of non-disclosure agreement between an employee and employer that is used to silence a whistleblower is void.

OSC Eligibility and Exclusion

To be eligible for a reward, whistleblowers may be an employee, former employee, supplier, contractor or client. Culpable whistleblowers who have participated in the misconduct being reported may be eligible for an award depending on the degree to which the whistleblower is complicit in the misconduct. Individuals with roles in compliance, investigation, or audit functions are generally not eligible for an award. Business and organization cannot be whistleblowers.

Additionally, these whistleblowers must meet certain criteria, which includes providing voluntarily and original information by submitting an OSC whistleblower report to the Office of the Whistleblower. Original information means information that is not already known to the OSC and is obtained through independent knowledge and/or analysis. The information must be of high quality and contain sufficient information such as timely and credible facts.

If a person believes they have original information related to securities violation in Ontario, Canada, they can report in a few different ways.

Online: A potential whistleblower may submit information to the OSC through their online portal. The OSC encourages potential whistleblowers to read their submission guide and award eligibility and process information prior to submitting a report.

Anonymous reporting: A potential whistleblower who wishes to report anonymously must be represented by a lawyer who will complete, sign, and submit the whistleblower submission form and related documents on their behalf. However, for an anonymous whistleblower to receive a reward for their submission, they must provide the Commission with their identity.

Internal Reporting: The OSC encourages whistleblowers who are employees to report potential violations of Ontario securities law in the workplace through an internal compliance and reporting mechanism in accordance with their employer’s internal reporting protocols. To receive a reward, the whistleblower must also inform the OSC of their report within 120 days of the initial internal report.

However, reporting internally is not required, and the National Whistleblower Center recommends that whistleblowers not make any disclosures internally until after they consult a whistleblower attorney.

Once a whistleblower meets the criteria to receive a reward, the amount they receive depends on the total monetary sanctions imposed; the amount of money collected by the OSC; and the Commission’s consideration of all the facts. According to the OSC, whistleblowers whose information leads to a successful enforcement action resulting in over CAD $1 million in penalties, are entitled to a monetary award between 5% to 15% of the total monetary sanctions ordered. The amount a whistleblower can receive is capped at CAD $5 million.

If multiple independent whistleblowers report separately on information related to the same conduct, they are placed in line for awards based on the timing of their report submission. If an award is to be divided amongst multiple whistleblowers, the amount will be based on effectiveness of the assistance provided by each whistleblower.

The OSC may publicly disclose if a whistleblower reward has been paid out as part of a news release but will not disclose the identity of the whistleblower as part of the release.