The Dodd-Frank Wall Street Reform and Consumer Protection Act enhanced the Securities Exchange Act in the wake of the 2008 financial crisis and created the Securities and Exchange Commission (SEC) Whistleblower Program as well as the Commodities Future Trading Commission (CFTC) Whistleblower Program. These programs have proven to be an extremely successful mechanism for identifying and prosecuting corporate fraud. Yet whistleblower protections under the Dodd-Frank Act, as well as the successful SEC and CFTC whistleblower programs, have been consistently under attack.

One case, Digital Realty Trust v. Somers (No. 16-1276), has proven to be particularly devastating to whistleblowers. Allies of big business attempted to convince the courts that employees who report violations of securities law to their supervisors or corporate compliance programs (as in, internally), but not to the SEC, are not protected from retaliation under the Dodd-Frank Act’s protection as SEC whistleblowers. The same issue applies to whistleblowers who do not first report to the CFTC.

In 2017, the National Whistleblower Center (NWC) submitted an amicus curiae brief to the U.S. Supreme Court, urging the Justices to reject the convoluted logic of big business allies and protect internal whistleblowers. Senator Charles Grassley, the then-Chairman of the Senate Judiciary Committee and the top-ranking official on the Senate Whistleblower Caucus, also filed a brief in support of the whistleblower. Sen. Grassley argued that “it would make no sense to read” the Dodd-Frank Act as only protecting employees’ internal disclosures if they “also reported to the SEC” stating the “obvious effect of petitioner’s interpretation will be to discourage internal reporting.”

Unfortunately, on February 21, 2018, the U.S. Supreme Court ruled in support of Digital Realty, and against whistleblowers. Stephen M. Kohn, Chairman of the Board of the National Whistleblower Center (NWC) and an attorney who has represented “internal” whistleblowers since 1984, described the Supreme Court decision in Digital Realty Trust v. Somers (No. 16-1276) as “devastating.”

“The overwhelming majority of whistleblower report violations directly to their managers and internal corporate compliance programs. Stripping internal whistleblowers of protection under the Dodd-Frank Act could negatively impact over 90% of corporate fraud retaliation cases,” Kohn said.

The U.S. Supreme Court’s decision in Digital Realty put countless internal whistleblowers in grave danger. Yet there is a clear solution.

Whistleblower Program Improvements Act

In May 2019, an act to amend the definition of whistleblower in the Securities and Exchange Act, H.R. 2515, was introduced in the House of Representatives. Titled “The Whistleblower Protection Reform Act,” the law would ensure that internal whistleblowers are protected just as Congress originally intended, undoing the devastating effects of Digital Realty. NWC strongly supported this legislation; attorneys with the NWC reviewed the legislation before its introduction and believe it is the best way to proactively protect whistleblowers through Congressional action moving forward. The law passed the House on July 9th, 2019.

In September 2019, Senator Charles Grassley (R-IA) introduced the bipartisan S.2529 in the Senate. Titled the Whistleblower Program Improvements Act, it follows the House bill in ensuring that internal whistleblowers are protected under the Dodd Frank Act. It also expedites the processing time for Dodd-Frank rewards following successful prosecutions, as currently, the process has been plagued with long delays. However, the 116th Congress ended before this bill could be passed.

There is reason to believe this legislation would enjoy broad public support. A Whistleblower News Network poll released in October 2020 shows that the American public considers corporate fraud a national priority and wants to help whistleblowers who expose it.

When asked if passing stronger laws that protect employees who report corporate fraud should be a priority for Congress, 82 percent of those surveyed agreed, with 29 percent stating that it should be an immediate priority. This poll should provide Congress with all the encouragement it needs to reintroduce whistleblower bills addressing private sector corruption like the Whistleblower Programs Improvement Act in the 117th Congress.

Understanding the Value of the Dodd-Frank Whistleblower Programs

The Dodd-Frank Wall Street Reform and Consumer Protection Act (often simply known as Dodd-Frank) enhanced the Securities Exchange Act in the wake of the 2008 financial crisis and created the SEC Whistleblower Program and CFTC Whistleblower Program. They offers rewards to qualified persons who provide information which leads to the recovery of monetary sanctions. The law is structured to ensure that whistleblowers’ information benefits the SEC and CFTC to the greatest extent possible.

Section 922 of the law provides that whistleblowers can file anonymous and confidential claims. Crucially, eligibility does not depend on U.S. citizenship. Whistleblowers who provide original information that leads to a successful enforcement action entitled to a mandatory reward of between 10% to 30% of the collected proceeds. This incentivizes whistleblowers to provide high-quality information on significant crimes. Specific whistleblower provisions under this law are explained by leading whistleblower attorneys here.

The SEC Whistleblower Program Works

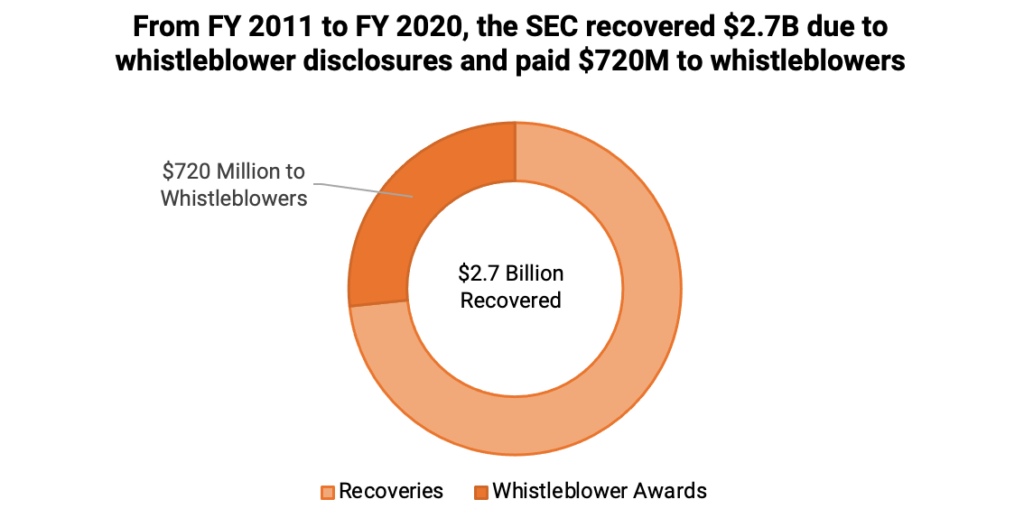

The data continues to prove the efficacy of the SEC whistleblower program. From program inception to the close of FY 2020, the SEC recovered over $2.7B from wrongdoers thanks to whistleblower disclosures and paid more than $720M to whistleblowers. In FY 2020 alone, the SEC received a record-breaking 6,900 whistleblower tips. The tips came from all 50 states as well as 78 countries outside of the United States.

The SEC’s Office of the Whistleblower’s 2017 annual report confirmed that “whistleblowers have provided tremendous value to its enforcement efforts and significantly helped investors.” It also confirmed that SEC whistleblower disclosures have “directly” contributed to “hundreds of millions of dollars returned to investors.” For example, that year alone the SEC paid $50 million in whistleblower rewards to 12 individuals.

The CFTC Whistleblower Program Works

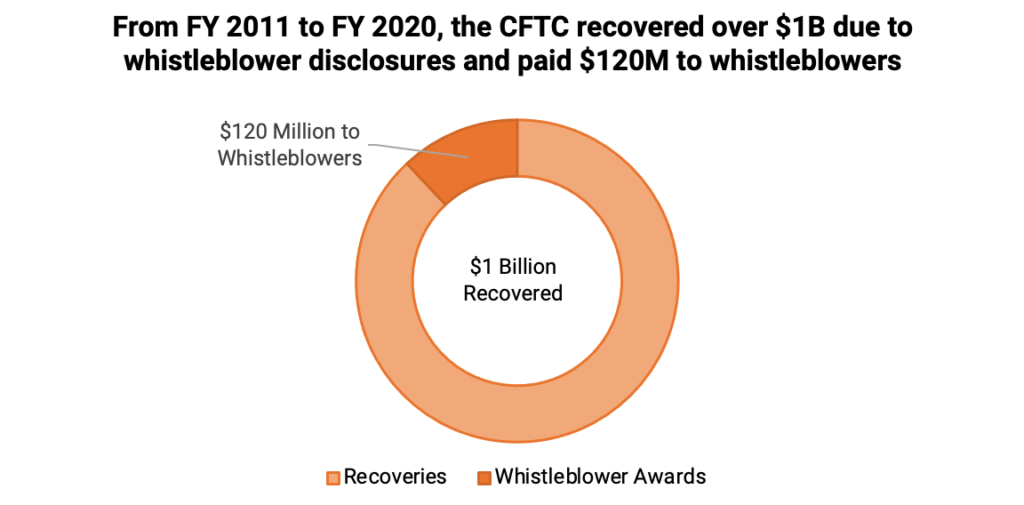

The data also continues to prove the efficacy of the CFTC whistleblower program.

From the inception of the Whistleblower Program in 2011 through FY 2020, the CFTC has issued 30 awards amounting to approximately $120 million. The Commission actions associated with those awards have resulted in sanctions orders totaling more than $1 billion.